How to Plan for Retirement

By Brian Bagnall | Uncategorized

HelpRetire.com has created financial success for people planning for retirement — Showing how to eliminate bad debt, reduce risks, generate better retirement returns, higher investment income and more tax advantages. Here are twelve of the things we have learned.

1. There are only 3 ways to increase your retirement income. Save more every month. Increase your current investment rates of return. Find an additional income source during retirement. Most retirees fall back on the 3rd option and work during retirement. However, options 1 and 2 are rarely ever explored.

2. The most important decision. How you reduce your risk of loss. Many people get into speculative investments. They have zero control. They are unable to see market shifts. And have great exposure to potential loss of capital. This exposure causes many to lose money. Which can mean being unable to retire.

3. Use the Rule of 72. This rule tells you how long it takes for your money to double. You divide 72 by the rate of return. If you have an 8% rate or return the math is as follows: 72/8 = 9 years. This means it will take 9 years for your $100,000 investment to become $200,000 if you have an 8% rate of return. This number helps you forecast what rates of return you need to retire.

4. Cash Flow is King. Many retirement minded individuals fail to have cash flowing investments. Building additional sources of monthly cash flow is intelligent. It provides consistent monthly income. Cash flow also gives tangible returns you see on a monthly basis. This helps if temporary set backs occur with your working income.

5. Insure your assets. Protecting against loss is simple. Use insurance. If your investment is unable to come with insurance against loss, then it is best avoided.

6. Look for hidden tax advantages. Most investments have zero advantages for your taxes. Look deeper into utilizing investment vehicles that do. For every dollar an investment saves you in taxes, you have an additional dollar for retirement.

7. Take a comprehensive view. Retirement is made up of many factors. Age, income, and savings are standard considerations. Also view: Monthly cash flow. Safety. Stability. Insurability. Overall Returns. Tax advantages. It is best to weigh all of these options together with each investment you look at. This gives you the complete picture.

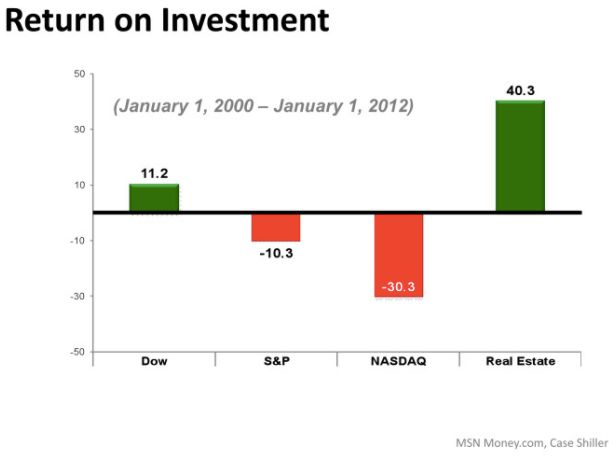

8. Stop doing what everyone else is doing. If you are doing what the average person is doing, how can you possibly expect anything other than average results? Most people invest their retirement funds into a combination of

- Stocks

- Bonds

- Mutual funds

- CD’s

- The average yearly return with this combination is 3% to 6%.

9. Account for Inflation. Inflation is when prices rise and your money decreases in purchasing power. Every year, the government releases an estimated rate of inflation for the previous year. Usually, it’s about 1% to 2% per year. The problem is it’s never in their best interest to release a high inflation rate because it shows the government is printing too much money. You can more accurately figure out true inflation by how much the cost rises for things you buy regularly. For example, according to the USA Today, the prices of these common items went up:

- Eggs went up 5.7%

- Tomatoes went up 6.9%

- Sausages went up 8.7%

- Potatoes went up 6.9%

- Oranges went up 12.2%

A standard 5% annual inflation is generally accepted and agreed upon by financial experts across the nation. If your retirement funds are growing at 6% yearly returns, this means you are effectively earning only 1% per year.

10. Define your objectives. Did you know a new study shows 83% of Americans aren’t going to be able to retire on time? The days of counting on Social Security for your retirement are long gone. Sadly, most Americans will never be able to maintain their lifestyle in retirement and that is primarily due to never defining clear objectives. By having clear objectives and deconstructing your retirement needs into tangible, bite sized, steps you are far more likely to reach your retirement objectives and needs.

11. Consider Alternative Investments. You might think getting a 11% yearly return is hard to do. Actually, it’s not. There are alternative investment vehicles which offer greater security with higher rates of return that grow tax free. Only most fail to look at these solutions because they aren’t marketed to you the way larger financial institutions do. These alternative solutions don’t make institutions money. This gives institutions zero motivation to tell you about all the options available to you.

There is a huge difference between a low rate of return and a high one. If you obtain better returns on your investments, you can drastically reduce your time to retirement and considerably increase your monthly budget. Here is an example using Bloomberg’s retirement calculator, starting with $0 savings, from age 35:

Annual contribution Return on Investment Total at age 65

$1,200 5% $79,727

$1,200 15% $238,825

As you can see, having a higher rate of return significantly affects your retirement savings. One rate leaves you working through retirement and possibly till you pass on. Another rate can have you traveling the world, doing as you please during your golden years.

How to integrate safety and security with higher rates of return for your retirement planning

In collaboration with you, HelpRetire.com offers a unique 360 degree approach to retirement planning. Objectively analyzing your current state of affairs. Where you want to plan toward reaching. Then building a clear roadmap to take you where you want to go.

Having full analysis with a complete financial perspective provides insights. Each insight gives valuable solutions to where holes exist in your complete retirement plan. Which should mean greater speed of growth, better safety, and more efficient use of your retirement dollars.

Invitation

HelpRetire.com has a comprehensive 45 minute training on retirement planning. We discuss the full range of options available to you, including alternative solutions which you may have never considered until now. If you would like to see the complete picture of solutions available to you for your retirement, please click here to grab your spot on the training.