The Right and Wrong Way to Invest in Real Estate

By Brian Bagnall | Investment

You’ve probably heard the stories from a friend or relative about investing in real estate and getting chewed up and spit out.

But you probably also know someone that has made a killing in real estate too.

Admittedly, you probably hear more horror stories that success stories.

What’s the reason for this?

That’s how much investment experts say you’ll need to save if you want to retire at age 60 and be able to draw just $3,000 a month during retirement.

If you’re like most people, you probably feel like that’s a lot of money to save to only draw $3,000 a month. You probably also feel like you’re severely behind in saving as well.

You’ve probably got some money saved but don’t really know what to do with it. Maybe you’ve put it in the stock market or mutual funds because “that’s what everyone else is doing.” Or worse yet, maybe you’re too scared to invest in anything at all and just have your money sitting in a money market or savings account.

Planning for your retirement is one of, if not the most important financial goals you will take on. And the stakes are quite high.

Making the wrong investment moves can transform your golden years from joy, freedom, and independence to penny pinching, dependence, and even poverty.

It means that you might have to continue working well past your retirement date. Or you might have to pick up a 2nd job. Or you might have to decrease your cost of living. Or, worse yet, you might never be able to retire at all (this is becoming more common).

The statistics are both shocking and scary: according to Hamilton Financial, 9 out of 10 people will retire in poverty or run out of money before passing away.

And things only seem to be getting worse.

Sadly, most Americans will just not be able to maintain their lifestyle in retirement and many will see their savings and investments come up short for even the most basic of expenses. But you’ll be one of the few who will be financially set if you follow the advice in this article.

3 Main Problems with Typical Investing Methods (stocks, mutual funds, etc.):

1). Low Returns & Not Enough Safety

A lot has been said about stocks; they have strong proponents and boast of many self-made millionaires, but at the same time many more investors have lost it all. The fact is, few stock investors ever strike it big. Do you personally know of anyone who struck it big on a stock? Probably not.

There are several common myths about stock market returns. Some believe an investor can expect an annual rate of return of 10%. Some say it’s 12% and others say as high as 15%. Unfortunately for many investors, this just isn’t true. The facts are that the average annual rate of return for the stock market measured over a period of 100+ years has been 6.3% annually. This is a far cry from the 10% to 15% many investors are expecting. This chart illustrates this:

Even the greatest stock investor to ever live, Warren Buffett, agrees:

Investing in stocks sounds very hands-off at first, but once you dig into the details it sounds a whole lot more like…well, running a business. Even though investing in stocks is better than leaving your money sit in a checking account or investing in bonds or CD’s, Investors should be well studied in daily financial news to assess the state of their portfolios, paying careful attention to quarterly earnings, commodity prices, unemployment reports and interest rates, to name a few.

Generally, investing in individual stocks is a task best done by investors with more time on their hands. You might eventually be able to make a killing investing in stocks but it takes years of hard work—same as in the job world.

Or you can leave it to a stock broker to invest your money. However, a stock broker doesn’t have any legal responsibility to do what’s best for you. Brokers make their money when they buy and sell your stocks and they get bonuses for pushing certain stocks, so it’s in their best interest to keep turning over your portfolio.

Mutual funds represent another way to invest in stocks. In addition to stocks, mutual funds can contain bonds or other cash alternatives. Basically, your money is pooled, along with the money of other investors, into a fund, which then invests in certain securities according to a stated investment strategy. Fees for mutual funds can be excessive. Common fees are the fund manager’s fee, a front-end load upon initial purchase, a back-end load upon sale, as well as early redemption charges.

Stocks and mutual funds have no guarantees – a bankrupt company can liquidate all its shares and leave investors with nothing. Also, a company can lie about it’s profits and losses like Enron did and wipe out your investment account overnight.

Most investment “experts” will tell you that index funds are your best bet for a safe and relatively lucrative investment.

They’re not completely off the mark.

For example, the S&P 500 has had an average return of 11% over the past 70 years. That sounds like a pretty darn good investment!

BUT that’s not the whole story, and it’s far from the BEST investment. 11% is the average return over a period of 70 years. During that period, there were HUGE amounts of volatility that would make your stomach churn day in and day out. Take 2015 for example. If you were to have invested in the Vanguard 500 Index Fund in 2015, you would have actually LOST 5.4%.

And what happens if you’re forced to retire in the middle of an economic downturn, as many people have found out over the last few years?

No one, regardless of what they want you to think, really knows where stocks are ultimately headed next week, next month, or next year… and if they did, they probably wouldn’t be sharing their secrets.

2). Average Choices, Average Results

If you’re doing what the average person is doing, how can you possibly expect anything other than average results? And the answer is: you can’t. Look around you and you’ll see plenty of people who had a good job, worked their butt off, invested in what they were supposed to invest in but are still left struggling during retirement. You don’t want to invest in the same things they’ve invested in only to get the same results.

3). Inflation… The Silent Killer

Now, a 6-7% return on stocks and mutual funds isn’t horrible… until, that is, you factor in inflation.

Inflation is when prices rise and your money decreases in purchasing power. Every year, the government tells us that the inflation rate is 1-2% per year. In reality, we all know that prices rise more than that. A better indication of what inflation actually is is to pay attention to how much the cost of the things you buy on a regular basis have risen. Investment experts agree that the real rate of inflation is about 5% per year.

Let’s take the 5% figure that most investment experts agree on and let’s assume that you’re making 6.3% on your retirement funds investing in Wall Street. When you subtract 5% inflation from your 6.3% yearly return, that leaves you earning 1.3% per year. You’re not going anywhere by making 1.3% on your money except to the poor house.

If your money is in a CD or savings account, you’re really in trouble. When you account for inflation, you’ll actually be LOSING money every year. You may as well light your money on fire, it’s that much of a bad investment.

Most people don’t realize the huge difference between a low return on investment and a high one.This is absolutely crucial to ensure that you retire on time. If you are able to obtain better returns on your investments, you can both drastically reduce the time it will take you to retire and considerably increase your monthly budget once you do so.

The best way to understand this is by looking at it graphically. Let’s use an example of someone who starts to save $100 a month for his retirement at age 35, and wants to retire at 65. We’ll project how much his annual contribution of $1,200 will total by the time he retires (30 years later) with a 6.3% interest rate (what the average American earns on his money) and a 13% interest rate (what you can safely earn).

| Annual Contribution | Interest Rate | Total at age 65 |

| $ 1,200.00 | 6.3% | $100,032.33 |

| $1,200.00 | 13% | $340,373.39 |

| *This numbers were calculated using Bloomberg’s retirement calculator at: http://www.edwardjones.com | ||

That’s a difference of $240,341.06. Shocking isn’t it? Now that you now there’s a problem…

Here’s the Solution

You’ll want your retirement investments to earn passively at the highest rate of return possible, while still making sure your money is safe so that you can live the retirement lifestyle you want to live.

It’s a dream many chase, but only a few manage to achieve. That’s evident by the number of people who are retiring broke.

It’s a shame, too, because it really isn’t hard to set up a real, hands-free, growing stream of passive income that delivers high returns safely and securely. Those that have lived long before us knew how to do it. And it’s responsible for building the fortunes of many of today’s millionaires and billionaires.

What if I told you that there was an investing tactic that was so simple to implement, and almost obvious, yet for whatever reason, you didn’t have it set up? And you know that if you did invest in it, you’d be making a lot more money without the risk?

You’d think I’d gone mad, right?

Well, prepare to be blown away as I disclose an investment vehicle you’re probably not using (but should be). This is the VERY same investment vehicle that Warren Buffett recommends.

It’s the very same investment vehicle that has personally allowed me to generate a 13% returns for years.

So where are the pros putting their money in 2018?

[DRUM ROLL] Real Estate.

But not just any real estate… Turnkey Real Estate.

Now, before you go running for the hills… it’s not the get calls at 2am in the morning to unclog a toilet, deal with tenants, or rehab (“flip”) a property in a war-zone kind of investing in real estate. It’s completely hands off. You’ll definitely want to read until the end before you judge otherwise you’ll miss out on something big.

There is a way to get all of the advantages of real estate without dealing with any of the hassles of being a landlord by adding turnkey rental properties to your portfolio.

Selecting turnkey properties makes everything simple for you. The best properties are selected by an experienced investor in a neighborhood that is statistically great for rentals (low vacancy, high rents, good returns). The property is then fixed up, filled with a quality tenant, and set up with a professional management company that will take care of everything from collecting the rents to dealing with repairs.

That’s right – you don’t have to rehab the property yourself, find someone to rent it nor manage it. It’s all taken care of for you. And you still get 13% annual returns (and that’s after all expenses too).

The important thing when investing in turnkey real estate is that you are open to investing in areas outside of where you live. Often times, the best investments (and returns) are only located in a few select cities. My saying is “Live where you live and invest where it makes sense.” And the turnkey aspect of that, where properties are fully managed for you, makes that totally possible.

Jay Dao, a 30-year-old engineer who lives in Santa Clara, California, felt priced out of the market in the Bay Area, so he turned to investing in more affordable regions and now owns properties in Chicago and Indianapolis.

“Turnkey investing is a much more passive form of real estate investing for busy professionals or investors who simply don’t want to put in that much work themselves, but still would like to own rental property,” says Dao, who chronicles his adventures in real estate on the blog FIFighter.com.

If you’ve spent your years exerting effort, and you are at or near retirement – you don’t want to be that senior greeter at Wal-Mart, on your feet for a whole shift. You don’t want to take on that second job in order to stretch your retirement funds. You worked hard, and you should be able to retire in comfort and enjoy the fruits of a productive life. This is the answer for you if the image of getting up and getting dressed to go out in all kinds of weather to report to a job and clock in and be under someone’s watch like a little kiddo makes you shudder. Those days should be behind you instead of ahead of you.

Most people don’t have the cash lying around to purchase these properties but most people don’t know that you can actually purchase real estate with your retirement funds using the power of a Self-Directed IRA. The IRS made this possible way back in 1974. And your money can grow tax-free too.

This Method is Even Warren Buffett Approved

Most people know Warren Buffett as the guy that made his money in stocks. Here’s a clip of Warren Buffett telling CNBC things like “Houses are even better than stocks” and “I’d buy up a couple hundred thousands single-family homes if I could.”

Many investors take their cues from Buffett on which companies and sectors to invest in. The opportunities in real estate provide tangible assets with tax advantages, and deliver returns unrelated to the stock market’s daily movements.

Real estate has created more wealth in America than almost any other method of investing. It provides the opportunity to generate income from rent and appreciation. Real estate tends to perform really well over long periods of time and the rewards can add a great deal to your chances of retiring on time.

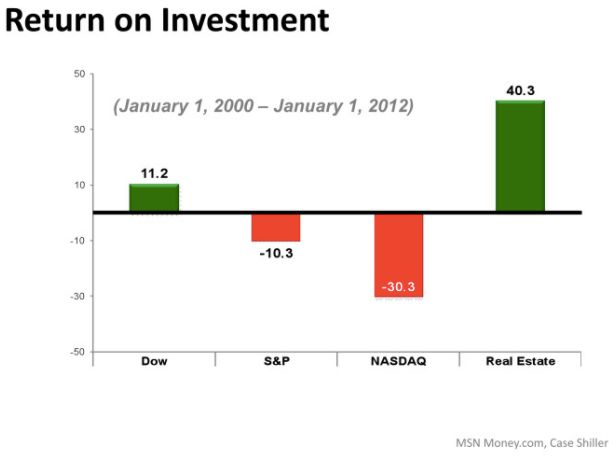

Even during a period with the dot-com bubble and Financial Crisis, Real Estate investors saw a bigger cumulative return than US stock owners:

So, what makes Real Estate such an amazing investment vehicle?

- Real Estate is a tangible asset; you can see it and touch it and you control it too. It’s not an intangible line item on an investment statement.

- Make double digit returns. The average rate of return investing in stocks and mutual funds is 6.3%. After you account for inflation, you’d be lucky to make 1.3% on your money every year. Making 13% on your money with real estate will really be able to make your money grow.

- You have the ability to IMPROVE your investment. You can renovate and change your properties to increase their value rather than just ‘hoping’ your stock options increase in value… the power is in YOUR hands.

- 8th wonder of the world. You get to take advantage of what Einstein called the 8th wonder of the world: the power of compound interest

- Passive cashflow. When you retire, you can live off of the cash flow without touching the principle so that you can pass the cash flow on to your family when you are gone and they can pass it onto their children when they pass. A great way to build up your family fortune!

- It’s safer than most investment methods. Don’t let anyone ever tell you that any investment method is 100% safe. Every investment comes with some element of risk. Real estate just happens to be one of the safest and most secure things out there (a lot safer than stocks). Rents typically don’t go down so your cash flow will be safe (have you ever had a landlord lower the rent?). Buying a turnkey property helps eliminate most of the risk because it eliminates the learning curve of going off and doing it on your own. You’re leveraging other peoples YEARS of experience. The housing hiccup of the past decade left many wary about entering the real estate realm, but if you look at fifty years of history instead of ten you’ll see that no investment is as secure a way of building wealth. Real estate can have its ups and downs, even if it’s nowhere near as cyclical as stocks. The sudden kind of big crashes like we saw in 2008 are far outside the norm. By investing for cash flow instead of appreciation, you become all but immune to real estate bubbles.

- Tax advantages. There are also tax advantages over stock and bond investing: owners can depreciate properties, and can use 1031 exchanges on sales to defer capital gains taxes. If you’re buying within a SDIRA, your profits grow tax-free (as well as the appreciation).

The old saying is almost right: “you have to spend money—or time—to make money.” As we’ve covered, stocks, mutual funds, and annuities require you to spend both time and money to make money. Real Estate does too, but with some large scale differences. Real Estate only requires an initial investment and the very occasional email—as little as once a year, when everything goes smoothly.

If predictability and peace-of-mind are what you’re after, real estate offers a much safer alternative and I can show you how to do it here.

Others, just like you, are ALREADY making a killing in the Real Estate Market.

One of our readers, Marty Murray invested $84k total to buy 2 investment properties a few months ago. He wants to retire in 20 years. As long as continues to reinvest the profits until he retires (compound interest), in 20 years he’ll have 20 rental properties, $109,788 a year in cash flow, and $887,740 in cash and equity.

If he would have invested the same amount in stocks, making the average return of 6.3%, he would have only had $285,065 at the end of 20 years. That’s a difference of $602,674.

And the biggest thing? Before Marty came on our masterclass – he had ZERO knowledge about ANYTHING related to Real Estate… and now he’s on track for a $800,000+ payday.

The Big Question Is… How Much Money Are YOU Losing?

Assuming you’re getting average returns on your investments right now (6.3%),

- If you want to retire in 15 years: For every $100k you have right now, you’re losing $316,565

- If you want to retire in 20 years: For every $100k you have right now, you’re losing $726,313

This is the amount you’re losing by choosing not to invest in real estate. And that’s for every $100k that you have in your investment accounts. Shocking isn’t it?

That’s the impact that investing your money like a pro can have on your long term financial future. If you like the investment plan I laid out here and you want to reclaim the money you’re leaving on the table, I can show you how to do that on a free training we’re holding here.

Here’s What to Do Next

Regardless of the investing mistakes you’ve made in the past, the biggest investing mistake that you can make RIGHT NOW is to not invest at all, or to put off investing until later.

It’s never too early (or too late) to start making changes to your retirement plan to make sure that you’re getting the best return possible so that you can Enjoy retirement on your terms.

So you’ve read this article and found some things you could be doing better. But what exactly should you do next? Well, you have 2 choices: 1. Be average or 2. Be smart

An average person would click away from this page and go about doing whatever they were doing and pretend they don’t have an investment problem.

A smart person will say to themselves, “I really need to stop procrastinating on my retirement accounts and take an active interest… right now.”

To help those that are smart, I just created a new MasterClass to help you get a better idea of what your next steps should be.

Any worthwhile passive income stream requires at least a little bit of learning. You need to know what your money’s doing even if you’re not doing anything yourself. You can learn more about turnkey real estate and generating a truly passive income in this MasterClass, and get started building your work-free future today!

If you have a certain retirement lifestyle in mind, this can help you live that life. If you cringe at the notion that your money will run out while you are still healthy, vibrant and living life, this can help you avoid that unfortunate outcome.

Remember, this is a hands-off opportunity. There is no labor on your part, no effort to upkeep the property, no property restoration or management headaches.

Hands down, one of the best things that you can do make sure that you retire on time (or early) and still be able to maintain your current lifestyle is investing in real estate.

==> This training is happening this week only and there are only 250 seats available so if you’re serious, you NEED to click here to register now.

If you are able to grab a seat, you’ll walk away with a retirement plan with specific, measurable financial goals and a custom investment strategy to fit your needs that you can immediately implement to double or even triple your current ROI.

If for any reason you aren’t able to get on the webclass, I still strongly encourage you to find an investment professional who has a proven success record. It can cut years off your retirement plan and seriously increase the money you’ll have available once you do.

Your financial future DEPENDS on it.

If you found this article helpful, don’t forget to share it and leave a comment below. 🙂 I try and respond to every comment.