Many people know Warren Buffett as the champion of value and index investing. But there is an asset class Buffett prefers even to value stocks and mutual funds. “If I had a way of buying a couple hundred thousand single family homes, and had a way of managing them … I would load up on them,” he said in a 2013 CNBC interview . The low interest rates and distressed prices from the Great Recession may scare off some investors, but they provide just the kind of long-term growth opportunity Buffett is known for finding.

Real Estate investing differs from stock and bond trading in several ways. Stocks and bonds are backed by a piece of paper and by how much everyone else believes the company can pay you back. By contrast, real estate is a ‘hard asset’: regardless of what someone else will pay you for your land, you own that land and can develop or sell it. There are also tax advantages over stock and bond investing: owners can deduct mortgage interest payments and depreciate properties, and can use 1031 exchanges on sales to defer capital gains taxes.

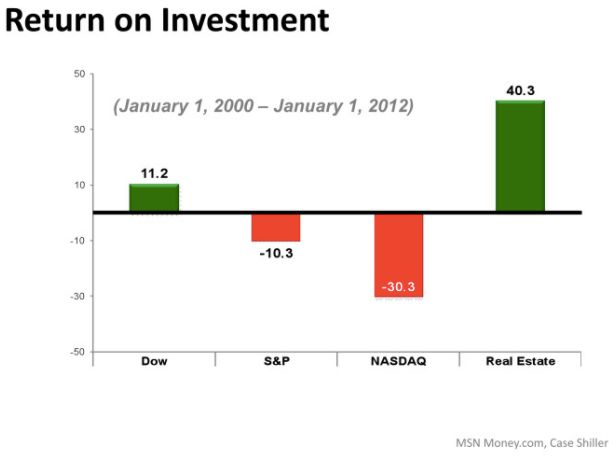

Lastly, Real Estate returns differ from traditional investments like stocks and bonds. Even during a period with the dot-com bubble and Financial Crisis, Real Estate investors saw a bigger cumulative return than US stock owners:

Many investors take their cues from Buffett on which companies and sectors to invest in. The opportunities in real estate provide tangible assets with tax advantages, and deliver returns unrelated to the stock market’s daily movements. Companies like ours offer management solutions to Buffett’s condition above, and provide great direct access to property investing.

Brian Bagnall is an in-demand author, speaker, and real estate investor who has written several books and spoken at conferences throughout the United States. He's shared the stage with business greats like Daymond John from Shark Tank. Brian actually practices what he preaches. He began his investment empire with just $3,000 in start-up capital and has gone on to purchase over 100 properties (and counting) all over the country. Brian turned his small investment into a multi-million dollar success.